I just got this game and I’m having a blast, this is the style of game I’ve been hungry for for a long time.

- 4 Posts

- 77 Comments

1·1 year ago

1·1 year ago500 internal errors in console, video doesn’t play

I agree, but it should still be retired regardless of intended usage - history matters; we don’t have to mistakenly other people to show off cool screenshots

i’d settle for more sidewalks in my town

on some streets they just paint a line down the road and call it a sidewalk - one of these is on a road touching an elementary school

3·1 year ago

3·1 year agoI’ve read the thread; Rust-folk I recognize seem to accept that this was done to reduce compile time without suspecting bad-faith, but I can’t independently verify that.

There’s a post in there where sometime tries to manually compile the same binary to verify that it matches the shipped binary and they were not able to do it, but there could be a good reason for that. Reproducible builds are hard.

It’s “rice” because it’s asian; it’s a derogatory term used towards people and their cars. When I was younger, this term was used against asian drivers and their asian cars - and it was not a compliment.

Looking at Urban Dictionary I see no mention of this anti-asian side of it, but it was there when I was growing up. Maybe others can chime in with their experience, I imagine it wasn’t the same everywhere.

Not implying the people using it here are being racist, I don’t think they are aware of what I’m recalling here.

A borderline racial slur about making things look good without substance behind the appearance: e.g.: “riced-up Honda civic”

Office is weird about it because of their OneDrive product

Their entire worldview is an anxiety buffet; they’ve got something for everyone, all they need to bring is unmanaged fear

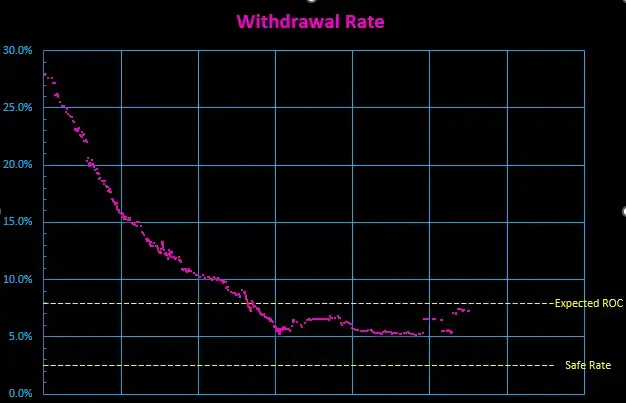

This is not answering your question (I can’t argue for my current SWR, it’s the trinity study minus a random fudge factor), but I’ve implemented an idea that I think others would benefit from.

I’ve been tracking my current withdrawal rate through time, based on my periodic calculation of baseline expenses. I suppose I could use actual expenses, but that’s remarkably volatile, so instead I take the 6 month average of recurring costs.

The benefit is a nice time series graph I can watch. I can plot a horizontal line for my current expected return on capital, and another for my safe withdrawal rate.

The net result is a lot of information condensed nicely. You can see at a glance if you’re trending towards safety, or away from it.

14·1 year ago

14·1 year agomost of the people buying these are buying a costume, not a work vehicle, if my neighbors are any indication

it’s a status symbol

4·1 year ago

4·1 year agoI’m not saying there isn’t a backdoor, but I can comfortably say that the user who posted that is nuts.

https://www.rbcroyalbank.com/rates/prime.html

RBC has increased their prime rate to 7.2%; was 6.7% in May

That’ll cost about a million dollars in savings to sustain long term, assuming you’re invested in the stock market and you withdraw 4% a year (“safe withdrawal rate”)

Good luck everybody 😕

I’m not going to get excited about any “deceleration”; this is still an increase. And due to “base effects”,1 we’re comparing against high values. Until it’s steeply negative it’s nothing to get excited about.

1 year over year measures compare now versus a year ago. if a year ago was unusually high, you’d expect this comparison to revert to the mean over time as the window shifts forward; it could have more to do with what you’re comparing to (a year ago) than what’s happening today

2·1 year ago

2·1 year agoit crashed the first time I tried to reply to this post

Hard agree; I think academics and programmers are especially susceptible to this. It’s an addiction that hooks in intellectual hubris, a condition I have some experience with.

I spent a lot of time learning from traders, and learning statistics. Most folks in trading use misleading profit and loss metrics to see if something is worth trading. I used the same kind of backtests, but I layered Bayesian inferencing on top of it.

I studied machine learning with Andrew Ng’s courses, studied deep learning with Ian Goodfellow’s book. Most importantly I took a course run by university professor and researcher in anthropology, Richard McElreath. I did my best to faithfully apply what I learned, though I am sure I strayed from academic standards.

At that point I had been doing this for years, for countless hours. It was my only hobby, and I dive hard into hobbies.

I tried my damnedest to be predictive every which way. I kept meticulous records to avoid fooling myself. Sometimes my models fooled me, and sometimes they combined with luck for my records to fool me. Long term, it’s pretty clear. No evidence of any edge, ever, for any approach taken.

At the end of all of this toil and labour, I have the skills I learned along the way: statistical skepticism, a hands-on understanding of fat tails, an appreciation for the experience of randomness and the highs and lows of gambling. I think that’s worth a lot - but I also think you can learn that a lot easier some other way.

I have done very well with buy and hold, it’s fantastic. There’s some bullshit in how you assign your portfolio - what proportions of what exposures - but its very profitable and exceptionally low stress compared to trading. It definitely has a better Sharpe/sortino/ulcer metric.

I’m too early in the game to know this well, but I feel the lack of mod support. This feels like a game that would really thrive with community support, but they have no plans on supporting mods or open sourcing it. They are currently working on a new project that they haven’t elaborated on yet.

Still, I got this game for $14 and if I can find some people to play with I’m absolutely going to get my money’s worth - this kind of game just doesn’t exist with this level of depth. I love the technical detail of how the ship works on and how the systems interact with each other.