“Growth for the sake of growth is the ideology of the cancer cell”

The stock price will fall if we don’t make more money then we did last year.

- But why?

Because we are legally obliged to do what is best for shareholder, or they can sue us.

- Right so the company needs to make more money again and again and again until the company or the world dies

About sums it up

Accurate. The laws need to find a balance as I get shareholders who took a risk on business would like to see a return, but it is way too slanted to the point that the risk is on our entire society. We need people to be in those laws not just shareholders.

Maybe stock market was a mistake?

Our implementation certainly is.

See Norwegian Sovereign Wealth Fund for more…

I think it’s a great idea in theory. Basically a form of decentralised loans. You need money to invest, you sell shares of your company to get some cash. In return the shareholders get a return if you succeed. And of course they can sell their shares if now your company is worth more. Seems alright with me tbh.

But nowadays it just seems like a fucking casino.

I don’t know if you can have that ideology without it eventually turning into what it currently is.

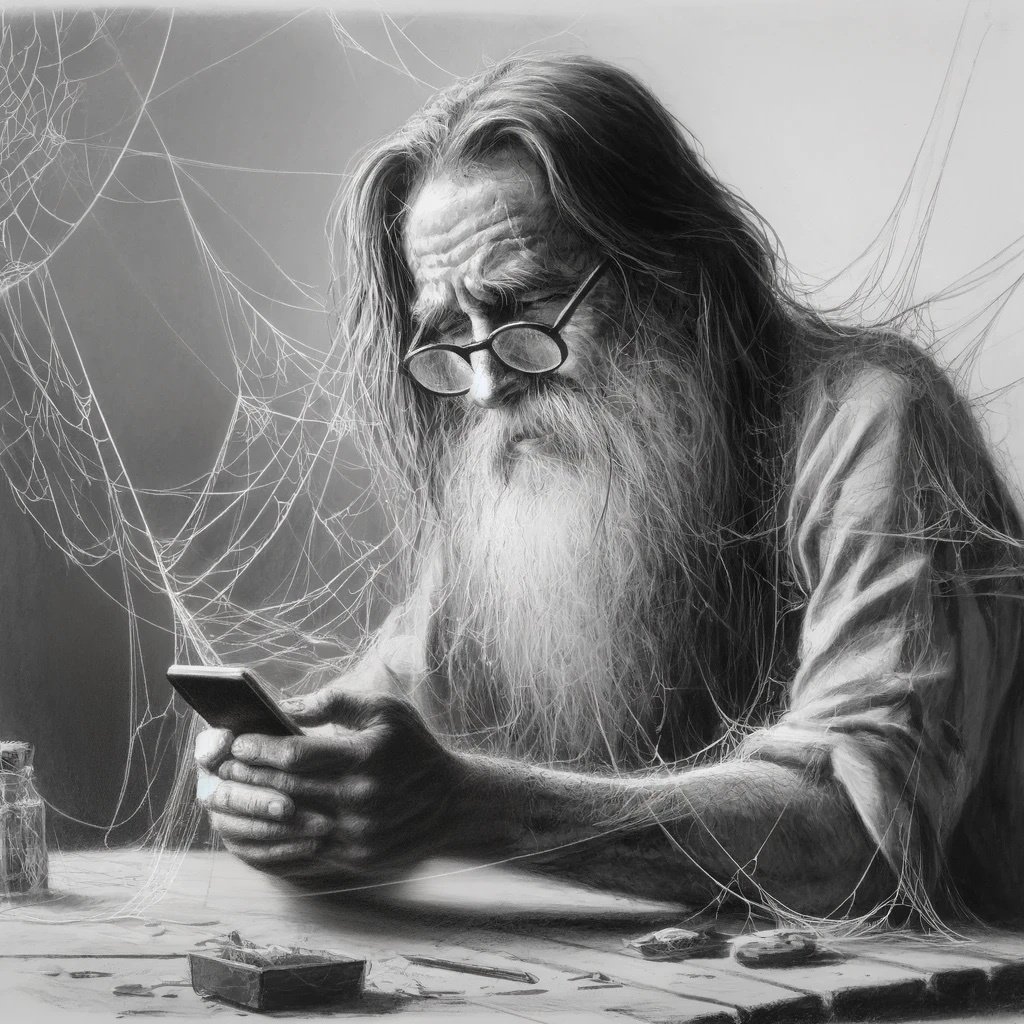

I’m by no means an expert. So I asked the old CharlieGPT

This list seems pretty good to me though:

Transforming the stock market from its current state, which many perceive as being overly speculative, to a more stable and purposeful system would be challenging. However, here are some suggestions that could help mitigate its “casino-like” nature:

-

Limit High-Frequency Trading (HFT): HFT can exacerbate market volatility. Some argue it provides liquidity, while others feel it allows for manipulation. By setting limits or additional regulations on HFT, you might reduce some of the rapid, short-term fluctuations.

-

Enhance Financial Education: Educating the public about the fundamental analysis of companies, rather than speculative trading, can lead to a more informed investor base that makes decisions based on a company’s intrinsic value, not short-term price movements.

-

Tax Incentives for Long-Term Holding: Offer tax benefits for long-term investments. For example, increase capital gains tax for stocks held less than a year and reduce it for those held longer. This would incentivize investors to think long-term.

-

Increase Transparency: Companies could be required to disclose more about their financial health and business operations, making it easier for investors to make informed decisions.

-

Reduce Leverage: Limit the amount of leverage retail investors can use. Excessive borrowing to buy stocks can magnify gains but also amplify losses, leading to more volatile markets.

-

Strengthen Short-Selling Regulations: While short-selling can be a useful tool for price discovery, unrestricted or manipulative shorting can destabilize markets. Strengthening regulations and increasing transparency around short positions might help.

-

Limit Derivatives or Complex Financial Products: Overly complex financial products can mask risk. By limiting or more strictly regulating these products, one might reduce systemic risks.

-

Robust Regulatory Oversight: Enhance the powers and resources of regulatory bodies to monitor market manipulations, insider trading, and other unethical practices.

-

Circuit Breakers: Strengthen and refine circuit breakers, which are mechanisms that temporarily halt trading on an exchange during significant declines for predefined periods.

-

Restrict Speculative Products for Retail Investors: Limit access to highly speculative or complex products for inexperienced retail investors.

-

Promote Stakeholder Capitalism: Shift the focus from purely shareholder returns to considering other stakeholders, such as employees, the community, and the environment. This can encourage companies to think long-term and align their strategies with broader societal benefits.

-

Enhanced Shareholder Rights: Grant shareholders more power in corporate decision-making, making it easier for them to hold company executives accountable.

Remember, the stock market serves as a crucial mechanism for companies to raise capital and for investors to grow wealth over time. Any regulations or reforms should be considered carefully to ensure they do not stifle innovation or economic growth.

Those sound like a great ideas, although I have to question the immense burden it would put on any governing authority, still seems better than the current system though.

As a counterpoint, stock markets (or any structured form of capital investment) require infinite growth, not only is this unsustainable, but it will always prioritize the profit motive over ethical concerns.

In addition, in a market where capital controls expansion, it will always benefit those with capital and by extension power to loosen those regulations.

To summarize, regulation will win you the battle but never the war.

These are just AI ramblings. But for the sake of the argument I don’t think the stock market requires infinite growth per se. Shareholders could just as well be happy with the dividend payout. Say you gave your apple farmer 20 units of wood to build a fence and storage, and in return he gives you an X amount of apples per fiscal quarter.

But this is hypothetical and in the capitalist system we enjoy you are right of course.

Though I will say that we could definitely regulate more. I would always be more inclined to put my faith in a regulatory body than the powers of the free market.

-

Needs more socialism. But we know how that goes…

It isn’t a great idea even in theory. Even ideally, workers inalienable rights to appropriate the fruits of their labor and to democracy are still violated. These rights flow from the moral principle that legal and de facto responsibility should match. In a company, employees are jointly de facto responsible for using up the inputs to produce the outputs, but receive 0% of property rights and liabilities. The employer is held solely legally responsible resulting in a mismatch

Someone tell them they don’t have to follow Steve Jobs in everything.

Also fire.

“OH MY GOD! WE’RE HAVING A FIRE… Sale.”

Tissue. A cancer tissue.

Cells are expendable in pursuit of infinite growth.

This is too perfect of an analogy…

I thought this was about a cereal for a hot second.

I love Apple Jacks. I haven’t had them in years.

Why don’t they taste like apples!? (ノಠ益ಠ)ノ彡┻━┻

Wait until you hear about Grape Nuts.

Are those The Grapist’s testicles?

I’m gonna tie you to the radiator!

This made me lol

deleted by creator

Really? I’ve never even tried them but I always assumed they were basically apple flavored cheerios.

They’re a very strong artificial cinnamon flavor.

Apple Jacks are my number two, only behind Cinnamon Toast Crunch.

Also, number two, behind. Heh.

That joke was brought to you by lactose intolerance, btw.

I scrolled away and had to come back because I just kept repeating the sentence in my head. If Apple Jacks gets $19B in profit I better join the cereal industry.

Is this thread a secret marketing ploy?!?!? Now I want some delicious fake apple cereal!

Glad I wasn’t the only one.

The cereal is that good, I wasn’t doubting they were pulling that XD

I thought I was really out of the loop. A brand I haven’t heard in over 20 years has been killin it.

Please vote with your money. Don’t waste money and buy overpriced stuff and certainly don’t support this kind of business practice. And fuck the shareholders too. If they want money, then work like most people.

Already do. Used to buy new phone every year. Now it’s every three years or so. That is completely due to price and lack of compelling innovation. Don’t care if shareholders make money or not. I just like good value.

I’m the same. I just got a 15 as my xr screen is cracked and the batter lasts half a day.

I’m home sick and didn’t even open the box yet.

I’m not particularly excited for a new phone, but my xr is just not working well enough any longer.

I am still using my XS max, just bought a $20 external battery for it.

A used smart battery case is pretty good too.

You can try 5 years with Fairphones, it’s the length of their warranty and you can repair it yourself easily.

Economic genius.

Is this sarcasm? I don’t think I’m a genius, just giving a reminder, and perhaps pointing a flaw in capitalism.

deleted by creator

deleted by creator

I read Apple Jack’s like the cereal and was confused

That was the point. There are several turns of phrase in the headline.

You like them apples?!?!

Same I was wondering what they were changing the price of a box to. Tough times.

deleted by creator

And idiots will pay it

One of the biggest drawbacks of buying iOS devices is you can’t leave. I swap everything out on my laptop and phones as needed, but on iOS you’re stuck with Apple’s app store, Apple’s operating system, oftentimes Apple hardware, and there’s nothing you can do about it. It simply ends up being so expensive.

It might feel that way, but people switch from one platform the other all the time.

It’s not impossible, just inconvenient. People nowadays often seem to conflate the two.

I’ve swapped between iOS and Android several times. There’s literally nothing stopping you from switching other than minor inconveniences.

You have a high opinion of the average idiot being able to navigate any of this. These are people that are confused by a two button mouse…

And you generally have a shitty opinion of people and their ability to navigate technology.

As with most things, it’s generally a cost benefit of convenience versus effort. Anyone can learn anything or transition to something else if they’re willing to put the effort into it. It’s just that most people aren’t willing to put the effort into most technologies and that’s their prerogative.

I work in IT man. The average person is incredibly tech illiterate.

You get paid to be at least competent at tech. Most people do not.

Unless there are apps you use regularly that cost a lot of money and you don’t want to pay for them again.

Do you regularly buy apps that cost hundreds of dollars? A vast majority of apps are within the $1-$5 range. We’re talking about buying phones that are well into the high hundreds to thousands of dollars. That’s a drop in the purchase and operating cost of the device.

Same said for other ecosystems like windows, android, playstation, Xbox and so on… Not apples fault.

I made a switch to linux recently and some of my paid software works there too.

Most steam games, Matlab. Wine and proton make it possible to run many Windows applications

Sure. I’m just explaining why it can be a problem if you want to switch.

Not directly. However they sure have learned on how to capitalise on it.

They do a great job of integrating devices. As for the App Store, us in the EU will soon be allowed to install alternatives. I think the deadline is the end of March.

deleted by creator

I do not understand all the rage, Apple does not provide any vital services or products. They can charge anything they want. If you don’t like it then don’t buy it.

but you still lock yourself in their offer space when you also bought devices that kind of depend on those services: music streaming for the homepod, fitness+ for watch, cloud storage for iphone photos…

every time you switch from apple to a third party, it’s ever so slightly less convenient, and they probably conceive their products around that notion.

Yes you have to decide if the cost of the convenience is worth the lock in and price of Apple products. At the end of the day you still have a choice.

That is their business model, no? The convenience and integration of their products is what makes Apple unique. Seems weird hold it against them.

Yea i buy apple because it just kinda works and it’s what i’ve used since my first mobile device, being an ipod 5. The switch to android just isn’t worth losing all my paid apps and whatever else

None of the products that had the price increased are locked in. Apple TV plus doesn’t even need an Apple device and has many competitors, Apple News has plenty of competitors, there are games you can buy without Apple Arcade though most do stupid in app purchases.

It’s always been trendy to rage at Apple and Apple owners. This is just the current rage.

If it’s “always” then it’s not a “trend.” Maybe if there is “always” rage at Apple, there is a good reason for it.

Yeah. For some, hate is eternal.

It’s supposed to be a personal computer - some folks don’t respect personal choices.

That is the thing with for profit companies, especially publicly traded ones. No matter how much they make, it is never enough. Next quarter must always be higher than this quarter or the world is on fire and heads will roll.

“our company only made 19 billion, we expected to make 19.1 billion, we are not sure how we are going to survive this”

Better fire 50000 people ASAP

Fire one million

Infinite growth.

The problem is their moat. If customers can easily go somewhere else hiking prices will have clear consequences.

*if there is actual competition.

Reddit has competition but also a big moat in that a lot of people need to collectively decide to move platform.

No disagreements from me. Enshittification at its finest.

I read the title 3 times before I realized it’s not about cereal

I am so happy that I’m not the only one that thought Apple Jacks were vastly more profitable than I had expected.

Honey smacks other coupon purveyors for substandard grifting.

Good one 😂

Or juice “profits.” (I’ve never understood people having cereal with juice, but maybe it works with Apple Jacks.)

They are epitome of passive aggressive capitalism. “Will keep doin unethical shit til they make a law not to and even then you have to sue me to make me stop”

It’s nestle’s MO.

I had to read the title several times before I understood that the article isn’t about Apple Jacks, the cereal.

Also I didn’t know Apple Jacks made juice profits, since when do they make juice?

deleted by creator

No one ever pays me in juice 🥺

And what are prices-to-juice profits? Like how much they make per balanced breakfast?

It took me 24 hours, saw the headline yesterday morning and skipped over it. Didn’t realize it wasn’t about cereal until this morning.

The solution is simple: Don’t participate in the Church of Steve Jobs, don’t turn yourself into an Apple disciple (and apologist).

The problem is that since there is no real competition all this shit propagates to other companies. If Apple is charging 1000 for a shitty phone, you better believe others will follow suit and charge 900-1000$

Meanwhile the fucking phone should actually cost 200$…

$200? what fantasy world do you live in?

The cost of making an iPhone 14 Pro was $570 and it sold for $800.

They are focused on services for making big profits, which is why you have to subscribe to a million services

I was exaggerating for effect. I just did a quick google:

A new report details how much it costs in materials to make Apple’s top-of-the line iPhone 14 Pro Max. According to Counterpoint Research’s bill of materials (BoM) analysis of the iPhone 14 Pro Max with 128GB, the cost is about $464. That model retails for $1,099

So I’m not far off in the price difference. Like I said overpriced bullshit. But you feel free to keep sucking that apple dong.

That’s just the materials used to make it though, what about R&D, software development, etc? I dislike apple but imo the phones are overpriced for a reason. Adding RAM or storage to their computers though… that’s real price gouging.

Nonsense. Apple has like a trillion dollars in cash laying around. So clearly their shit is marked up to such absurd levels, that not only does it cover all costs, including Rd, on top of all of that they still have a trillion in cash leftover. They don’t even know what to do with the money except lobby and bribe governments.

Stop defending these price gauging asshole mega corps FFS

The thing I loved about Apple 15+ years ago was that even though the hardware was expensive, it was semi modular and tightly integrated with the software and you got an offline product that you could also buy Apple server equipment and software for. 10 years ago was still ok but things were starting to erode.

These days there is no server software, no modularity, no ways to use enough of the new features without a cloud subscription and the hardware is just as expensive and designed with defects to limit it’s lifespan (in my opinion). They want to have their cake and eat it too. I was a proud Apple fan boy but not a blind one. Well now they can fuck off. Bye.

I’m now fanboying about Framework and Pine64.

Apple’s been ignoring professional users for a while now. Folks in sound and video production were the ones who kept them alive in the 90s. But they turned Final Cut Pro into iMovie+ and their professional machines are impossible to upgrade or repair.

Remember the outrigger cases? Or the G3/G4? Beautiful design, great airflow, and one latch and the whole thing opened up.

Remembering the G3 and G4s had daughterboards? So you can not only change out the memory, but also change out the CPU/GPU. It was a great time to be an Apple fan back then.

Yeah! IIRC there were even daughterboards with full Intel systems on them so you could run Windows/DOS applications

Oh ya!!! You could swap the IBM board or the Cirrix board. Oh man. Blast from the past.

Was also a fanboy 15+ years ago. First they got rid of the Macbook 17". Then they got started soldering memory to the motherboard. Thats when I left. It just got progressively worse ever since.

I can get the TV+ hike. I don’t like it, but I get it. When TV+ launched it had very little content and no one was going to pay for that little content unless it was cheap. But now there is a pretty good library of new stuff, and it’s usually of better quality than what’s floating around on HBO.

Arcade price hikes - now that seems like a good reason to cancel Arcade. If they’re going to add better games that take advantage of the new fast processors, I can understand console tier pricing. But the games still mostly feel like mobile games. And not mobile as in “Nintendo Switch,” mobile as in “flappy bird.”

The logic is that others raised subscription prices and got away with it, so they can too. Masks have come off in the last 1-2 years and corporations try to milk us for every last cent, using any excuse (e.g. Covid, energy prices) they can. Inflation is not a law of nature, it’s corporate greed for more profits

For All Mankind S4 comes out next month!!!

Oh shit finally, I love that show

!Get fucked Danny!<

Man hbo is just dead at this point.

You got downvoted, but I agree. HBO isn’t what is once was, although there are a few gems. TV+ seems to be the place where people are allowed to spend an ungodly amount of money on a show right now.

I thought the same thing until I found Scavengers Reign.

I’m so excited for that… But that’s definitely Williams St/Titmouse before the merger being awesome as usual with discovering new talent.

deleted by creator

Honestly, arcade is a cool idea, but it’s never been cool enough to buy on its own. I feel like the majority of people that have it just get it as part of Apple One.

Yeah, I agree. I might be cool if you have kids. I don’t, so I’d rather just buy the one or two mobile games I play each year.

We need to abolish public trading, or at least vastly overhaul what it means to invest in a company

Minimum investment times and mandatory profit sharing might help.

Make investors consider long-term and create income for shareholders from all profitable companies.

Right now a company can lose money while making shareholders rich, or make money while making shareholders poor. This is stupid.

Stock buybacks should be made illegal (well, just don’t allow them) again.

Also short selling. Maybe I don’t have a full understanding of how it works, but I don’t think you should be able to place money down in hopes of the decline of a company. I don’t think that really encapsulates the spirit of the word “investment”.

Like I thought the whole idea of stock was to put money into companies thag you believe in so they can have extra capital to grow, and then you get a cut of it. How in the world did people figure out a way to bet against companies and profit off of them losing? It just opens the doors for even more insider trading and corporate sabotage.

There was counterpoint I saw that advocated for the value of shorting.

You see this big successful company. You know that if they are caught doing something illegal or wildly unethical, you could profit by shorting. So you fund a bit of research to see if there are skeletons. Selling to an embargoed nation, poisoning an area, bribing officials.

Shorting provides a motivation to dig for dirt instead of just cheerleading a company blindly.

I agree that it doesn’t rub me the right way. The mechanism is interesting though.

Essentially what it is is you borrow a share of stock of Company X from John Smith.

You now owe John Smith 1 share and you sell that share for current market value of $100.

You now have $100 but still owe John Smith 1 share of stock, and interest based on how long you take to give him his stock back.

The stock now drops to $10.

You buy 1 share of stock for $10 and return the stock back to John Smith as well as some interest.

You now have a net +$90 (minus some interest) you didn’t have at the start of this. Voila, profit from stock going down. John Smith’s share is worth less now, so he loses out.

Why would John loan someone a share of his stock? Well if it maintains it’s value or goes up, then it’s you who lost because you owe John a share that you have to purchase for the same or more than you got for it, plus interest too.

The heart of the mechanism is loaning stock, aka loaning property of value. So preventing it might be tricky.

Perhaps also interesting is the fact that a loan never happens.

Instead, a contract is sold. The contract is for an option to buy (or sell) 100 shares at a certain price (strike).

So there is no loaning of shares, really. But the seller of an options contract has the obligation to sell (or buy) the shares at any time until the contract expiration date.

Sometimes, market participants borrow the shares instead of owning them. This is what I consider the shady part. Certain participants get a long time to “locate” the shares and are given a lot of leeway to do so. Often in the name of liquidity, they will just sell contracts without even going through the trouble of borrowing shares. They are allowed to if they believe they can locate the shares later.

This entire process allows for certain parties to basically create infinite shares from nothing. Believe it or not, this often gets abused. Money is basically siphoned from public companies in order to enrich Wall St.

When the stock price moves too much, which would put the stock counterfeiters at risk of insolvency, trading is halted.

Yeah, the problem sounds like we should be not allowing recursion, or regulating how many levels of recursion of allows for a reasonable level of liquidity and velocity of cash in an economy. Allowing for it to infinitely nest guarantees a bubble is going to pop somewhere eventually.

Sounds like an excellent start to me 👍

They are just mad that they lost to “right to repair” in California so they are throwing a “fuck em we will charge them double then” tantrum.

They did not lose, sir.

Fighting for years against right to repair, seeing the sentiment stay against them and the EU forcing them to be more repairable, leading to them suddenly jump on the right to repair train isn’t losing? Interesting.

They drafted this law via lobbying. They didn’t lose, but we didn’t win. And now the topic will get forgotten as we already have a law.

Considering they fought similar laws tooth and nail all over the world, I’d say getting them to even be repairable is a win.

Not yet.

This is just a whitewashing maneuver from apple in my opinion. And they got it through, so I don’t think this California thing a loss for apple. On the other hand, apple is indeed losing a bit at the EU site, I agree, but that was not what top commentor was talking about.

We’re Not Retreating; We’re Advancing in a Different Direction! -Apple

If you can not prevent a law from being written, you make sure it is written in your favor. Apple did just that.